Capitalise On Soaring Gold Prices With Gold Buyers

In today’s ever-evolving economic landscape in Australia, individuals are grappling with the challenge of navigating the future of our economy and the value of precious resources. As global markets escalate, inflation rates fluctuate, and trade disruptions continue (but gradually steady), Australians are treading cautiously amid their country’s recent depreciation against the US dollar. Paradoxically, this has paved the way for a remarkable upsurge in the current Australian gold prices.

At Gold Buyers, we empathise with our loyal customers’ concerns and remain steadfast in our commitment to keeping you informed and empowered during your gold selling journey. We recognise the wisdom of exercising prudence when making significant financial decisions amidst this economic flux. That’s precisely why we’re here — to provide you with a clear understanding of how and most importantly when, in this climate, your gold can yield enhanced economic value.

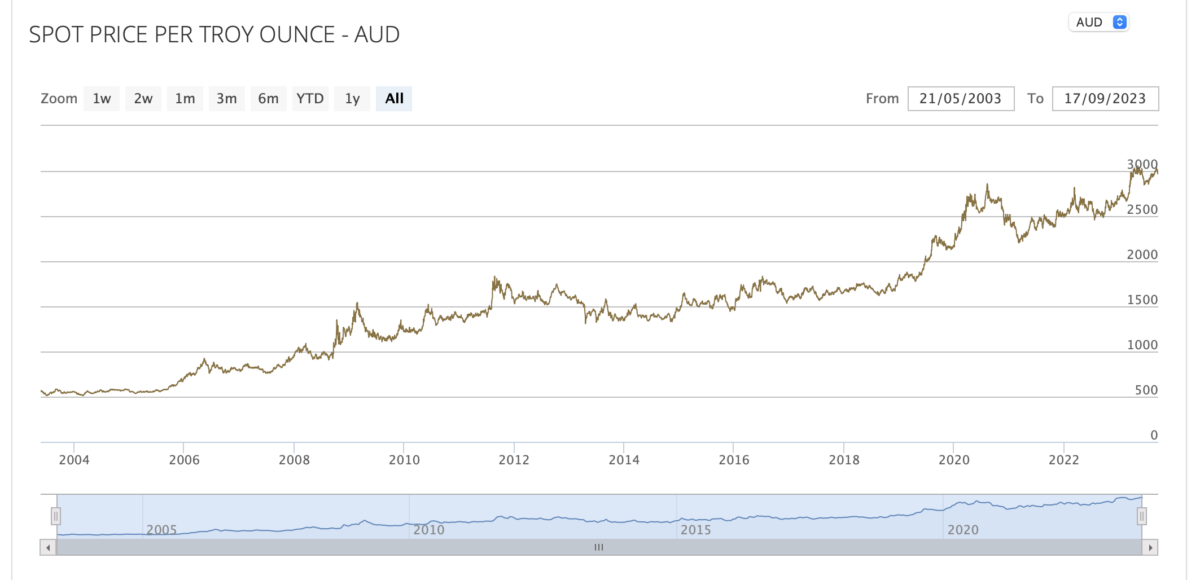

The Plummeting Australian Dollar

In the past few weeks, there has been a remarkable and notable weakening of the Australian dollar, plunging to record lows of $63.63 US cents. This downward trajectory of the Australian dollar vis-a-vis other international currencies has set the stage for significant shifts in the price of gold within Australia.

Image Source: Trading Economics

Factors Behind the Falling Australian Dollar:

Strong US Economy

A driving force behind the decline of the Australian dollar is the unexpectedly robust US economy. With the anticipation of the US Federal Reserve raising interest rates, the US dollar has gained considerable appeal among investors. In stark contrast, the Reserve Bank of Australia has maintained a steady cash rate. This divergence in interest rates has led to an influx of investment into US dollars, which consequently affects the Australian dollar’s value.

China’s Economic Rebound

Another substantial factor in this equation is China’s unexpected challenges in rebounding from the effects of the COVID-19 lockdowns. This situation has raised concerns regarding deflation and economic instability. As Australia’s major trading partner, China’s economic performance has a direct ripple effect on the Australian economy.

Inflation Hedge And Geopolitical Tensions Impacting The Gold Sector

The global landscape has been rife with geopolitical tensions and inflation rates are more than evident, investors are seeking safe-haven assets. Gold boasts a strong reputation as being a hedge against inflation and a safe-haven asset. The allure of gold as a safeguard for wealth, especially during tumultuous times, significantly bolsters its demand and value.

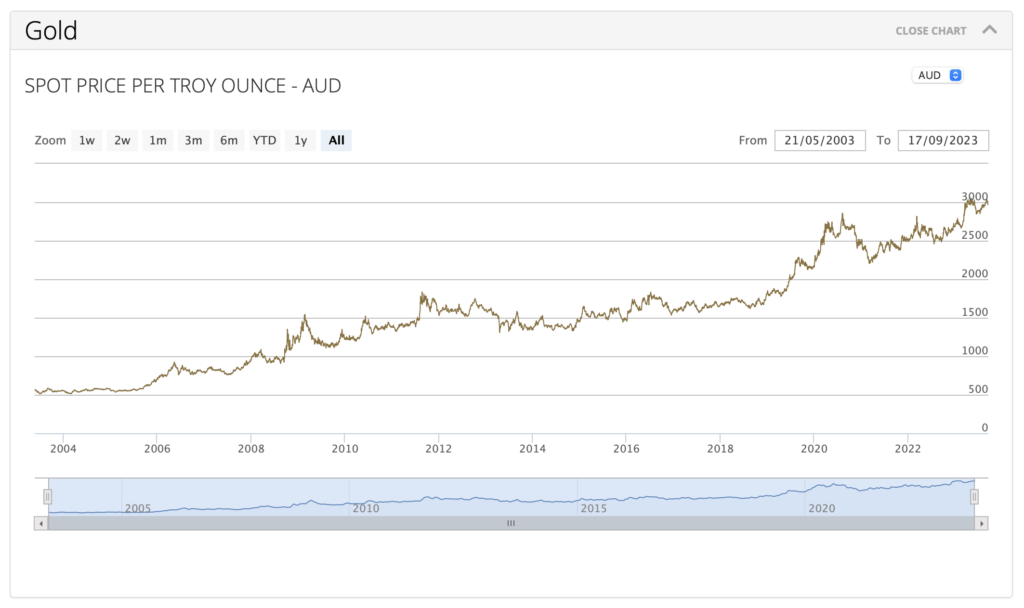

The Gold Price In Australian Dollars Surges, Presenting A Lucrative Opportunity

The culmination of these factors forms the backdrop for the surge in gold prices in Australia. As the Australian dollar struggles in international markets, it takes a greater number of Australian dollars to acquire a single ounce of gold, even if the global gold price remains relatively stable.

This fundamental shift has culminated in the gold price reaching a historic high in Australia, this month reaching an impressive $3,000 AUD per ounce.

Image Source: ABC Bullion

The Perfect Timing: Why You Should Sell Your Old Gold Now

These extraordinary market conditions underscore why the present moment is a great opportunity to be considering big financial gains.

With no certainty the price of gold will continue at this trajectory, now presents an opportune time for individuals to capitalise the high value of their old gold possessions, converting them into cash for the highest possible return.

Waiting for even higher prices may not be the wisest choice, as market dynamics can change rapidly.

Your Golden Opportunity Awaits

For those considering cashing in their gold, your perfect opportunity is now. With record-high prices and economic uncertainty, there’s no better time than now to exchange your old gold jewellery with gold buyers.

Don’t miss out on this golden moment; order your mail in pack today and transform your old gold into cash that can empower your financial future.