- 07/16/2024

- Tanya McDonough

- 0 Comments

- 1341 Views

- 0 Likes

- Lifestyle

Balancing the Budget

How Selling Gold Can Help with Household Expenses

Feeling the pinch at the grocery store? You’re not alone. Everyday Australians are having to be more mindful of their spending. Cutting back on luxuries and giving up extracurricular activities to ensure they are covering everyday necessities in their budget.

In this blog, we will discuss where you can make extra money by selling things you don’t need. We will also give tips on how to manage your household budget efficiently. Let’s start finding ways to ease the financial burden and give your family a financial boost!

Selling your unwanted items doesn’t mean you need to make signs to stick on the main road with an arrow pointing to your garage sale (although you can do that if you’re feeling crafty!). These days a sale is at the tip of your fingertips – it’s time to get on the apps, not that dating apps, the selling apps.

What Types of Items Should You Sell Online?

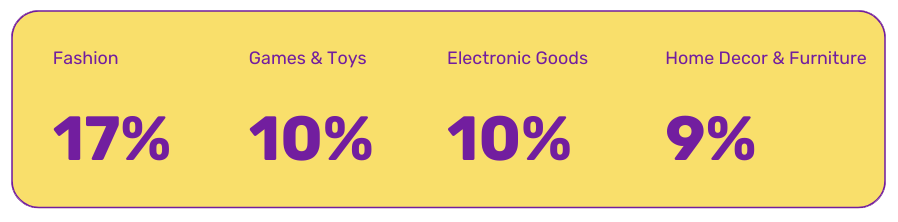

Wondering what items sell best online? According to Gumtree, these categories move quickly and fetch the highest prices:

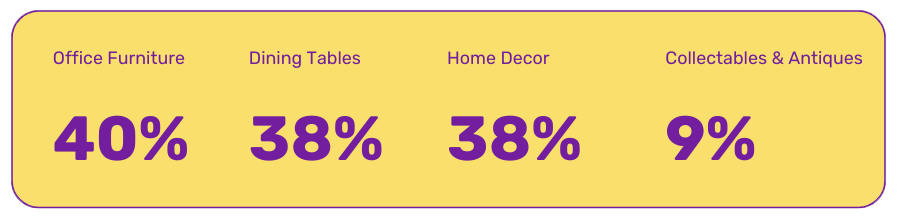

Looking ahead, Gumtree also highlights what Australians are keen to buy from the pre-loved market:

Where to sell your unwanted items:

We’ve created a list of our favourite apps and websites in Australia. You can start here to make some extra cash for your pocket!

Depop

Depop is a fashion marketplace tailored for the Gen Z and millennial crowd, where users can buy and sell trendy clothing and accessories. It’s ideal for fashion enthusiasts looking to declutter or update their wardrobes. The app is free to use, but Depop charges a 10% fee on each sale.

Facebook Marketplace

Facebook Marketplace allows users to buy and sell a wide variety of items within their local community. It’s aimed at anyone looking to sell household items, electronics, clothing, and more. It’s free to use with no listing fees, making it accessible for everyone.

Gumtree

Gumtree is a classifieds platform where users can sell almost anything, from furniture to vehicles. It’s popular in Australia and the UK. Basic listings are free, but there are options for paid upgrades to increase visibility. Click here to learn how to sell on Gumtree!

Poshmark

Poshmark is a social commerce platform for buying and selling new or secondhand fashion, aimed at women and men looking to sell clothing, accessories, and beauty products. Listing items is free, but Poshmark takes a 20% commission on sales over $15 and a flat fee of $2.95 for sales under $15.

OfferUp

OfferUp is a mobile-first marketplace for local buying and selling. It’s perfect for anyone looking to sell items like furniture, electronics, and household goods. The app is free to use, but there is an optional fee for promoting listings.

Gold Buyers Online

Gold Buyers Online specialises in purchasing your unwanted, broken or used gold. It’s aimed at individuals looking to sell their precious metals for cash. The service is straightforward and free to use, with transparent pricing based on the weight and karat of the items.

Selling Tip for Gold Buyers

How Different Gold Karats Affect the Price

When it comes to selling your gold, understanding the value of different karats can make a significant difference. The purity of gold is measured in karats (K), with 24K being pure gold. The higher the karat, the more gold content, and thus, a higher price of gold.

-

- 24K Gold Price in Australia: As the purest form of gold, 24K fetches the highest price per gram. It’s a great way to maximise your returns.

-

- 22K Gold Price: Slightly less pure than 24K, 22K gold is still highly valuable and sought after.

-

- 18K Gold Price: With 75% gold content, 18K is a popular choice for jewellery and offers a good balance between value and durability. The cost of 18K gold and its price by gram can vary but still provides a substantial amount.

-

- 9K Gold Price: Though lower in gold content (37.5%), 9K gold still holds value and can add up if you have multiple pieces.

By selling higher-karat gold, you could end up with more cash in your pocket, making it a viable option for boosting your household budget.

Top Tips for Managing the Household Budget Selling Tip for Gold Buyer

Track Your Spending: Use budgeting apps like Pocketbook and MoneyBrilliant to keep a record of all your expenses, from groceries to utility bills. These tools help you stay organised and identify areas where you can cut back in your cost of living spending.

Create a Budget Plan: Develop a monthly budget that includes all income, fixed expenses and luxury expenses. Tools like YNAB (You Need A Budget) and GoodBudget can assist you in allocating funds for essentials like housing, food, and utilities first, while setting aside money for savings and discretionary spending. Make sure all your income and expenses are noted in your budget.

Prioritise Savings: Treat savings like a mandatory bill. Set up automatic transfers in your bank account to your savings account to ensure you consistently put money aside for emergencies and future goals. Apps like Raiz and Spaceship Voyager can help you save and invest spare change effortlessly.

Reduce Unnecessary Expenses: Review your spending habits and identify non-essential costs you can eliminate or reduce, such as dining out, subscriptions, and impulse purchases. Use websites like Finder to compare and switch to better deals on utilities and insurance.

Plan for the Future: Set financial goals, whether it’s paying off debt, saving for a vacation, or investing in education. Having clear goals helps you stay motivated and focused on managing your budget effectively. Websites like ASIC’s MoneySmart offer free resources and tools to help you plan and manage your finances.

Follow these tips and use the right tools to improve your financial control and work towards a more secure future.